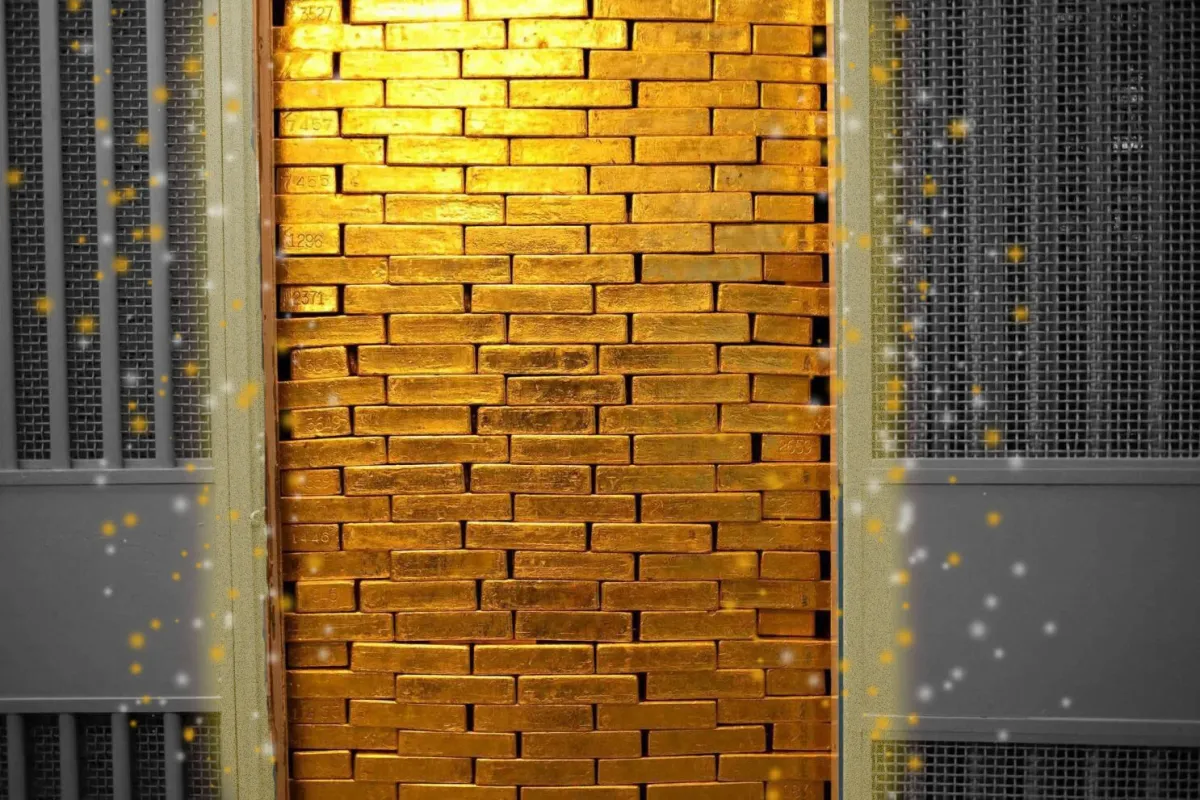

Countries Bring Gold Reserves Home

In this buzz: Repatriate for Security! Central Banks Safeguard Gold Reserves while Eyeing Emerging Market Bonds; and a bit more…

Repatriate for Security:

Central banks around the world are taking proactive steps to safeguard their gold reserves as ① geopolitical risks and the ② specter of potential sanctions loom large. According to a recent survey conducted by Invesco, over 85% of sovereign wealth funds and central banks anticipate higher inflation in the coming decade. This outlook has led to a growing interest in

→ gold and

→ emerging market bonds as appealing investment options.

The freezing of a significant portion of Russia’s gold and forex reserves by the West in response to the Ukraine invasion has served as a catalyst for this shift in strategy.

Key focus for central banks:

Repatriation of gold reserves has emerged as a key focus for central banks, signaling a desire for greater control and security. In the survey, nearly 60% of respondents acknowledged that the Russia incident has heightened the appeal of gold as a safe haven asset. As a result, central banks are favoring domestic storage, with 💡 68% of participants opting to keep their gold within their own countries, a notable increase from the previous year.

Diversification:

Geopolitical risks and concerns over rising US debt have prompted central banks to explore diversification away from the US dollar. While the majority still view the dollar as the world’s reserve currency without a viable alternative, some institutions perceive 💡the rising debt as a potential threat. As they seek alternative investment opportunities, infrastructure projects, particularly those linked to renewable energy, have gained prominence as an attractive asset class.

Fascinating:

India is becoming a top spot for investment for the second year in a row, partly because of concerns about China. Additionally, the “near-shoring” trend, characterized by companies establishing factories closer to their target markets, is fueling investment prospects in countries such as Mexico, Indonesia, and Brazil.

On the flip side:

China, Britain, and Italy aren’t looking as appealing to investors right now. Rising interest rates and the long-lasting effects of remote work and online shopping due to the pandemic have made property the least popular private asset class.

I guess, it’s all about adapting to the changing landscape and making smart investment moves.

* → A sovereign wealth fund (SWF): is a state-owned investment fund created from a country’s surplus reserves. It can be funded by various sources like:

① natural resource revenues,

② trade surpluses, and

③ privatizations.

The purpose of a SWF is to use this money to benefit the country’s economy and its people.

→ SWFs have different goals and ways of managing risks. : They can be grouped into different types, such as :

① funds for saving money for the future,

② funds for pension payments, or

③ funds that focus on specific industries.

Some SWFs invest in safe and easy-to-sell assets, like government debt, while others invest directly in businesses within the country.

→ One concern about SWFs is that: they are not always open about their investments and how they make decisions. This lack of transparency can make people wonder about their intentions and how they might affect the global economy. But overall, SWFs are important for countries to manage their extra money and can have an impact on the world’s financial markets.

TRENDING ORIGINALS

Never Miss What’s Happening In Business and Tech

Trusted By 450k+ Readers