Fallout

In this buzz: Silicon Valley Bank Financial (SVB); Signature Bank; First Republic Bank; Bank Run; the Oscars and more…

Equity futures rallied…

… Sunday night as Asian markets opened and Oscars were being handed out everywhere all at once in Hollywood. Investors were relieved at the news that U.S. would backstop depositors and institutions involved with the collapse of Silicon Valley Bank.

It’s not a bailout..

The government was quick to categorize this as absolutely not a bailout as bondholders would not be protected. Depositors were assured they would have access to all of their funds as of this morning as official announced that they would unwind SVB and Signature Bank.

Additionally,

… the Fed provided an additional lending facility that will provide loans up to one year for institutions affected by bank failures. First Republic Bank also spent the weekend shoring up reserves with help from the Fed and JP Morgan.

✳The equity market’s party fizzled before the open as Dow futures dropped 300 points and First Republic stock fell precipitously in the pre-open.

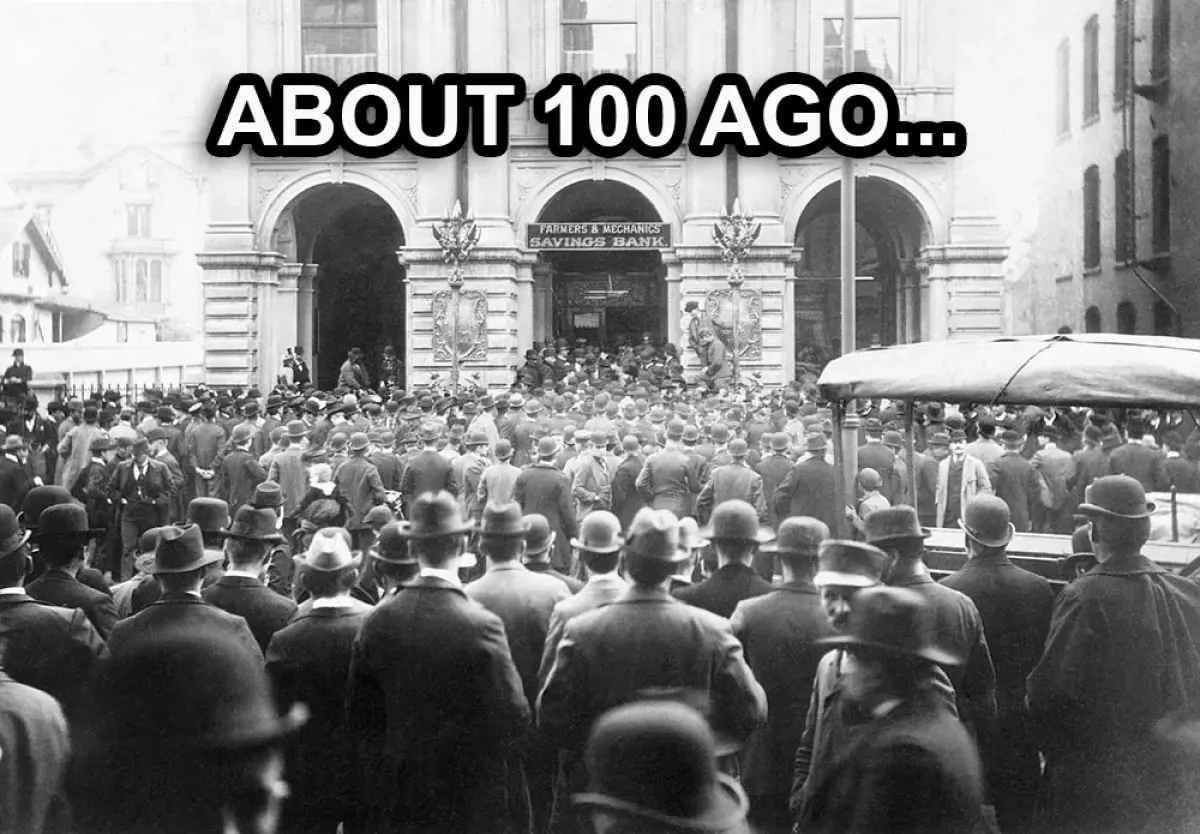

Contagious?

Concerns about contagion from the run on SVB are pressuring the banking sector as investor are concerned about further runs and the effects that the fastest rate hikes in history are having on banks’ fixed income portfolios. Anyone who look at a screen this weekend saw arguments for and against last week being the start of another GFC (Global Financial Crisis).

Is this time different?

Probably. History doesn’t repeat, it rhymes Mark Twain was purported to say. The issues that caused the great financial crises aren’t the same ones facing the banking industry today. ❗However, that doesn’t seem to provide much solace to depositors, investors and traders who are focus on what happens now.

It’s sure to be an interesting week… ✳bank runs, ✳CPI tomorrow and ✳the debate about the path of Fed hikes. It’s a lot.

GFC (Global Financial Crisis) The 2007–2008 financial crisis, or Global Financial Crisis (GFC), was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929).

– Predatory lending targeting low-income homebuyers, – excessive risk-taking by global financial institutions, – and the bursting of the United States housing bubble culminated in a “perfect storm.”

✳Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of ✳derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.[4

source:Investopedia

TRENDING ORIGINALS

Never Miss What’s Happening In Business and Tech

Trusted By 450k+ Readers