Mixed Signals

In this buzz: Taiwan Semiconductor, Lucid Group , Robinhood, Uber, Nvidia and more…

The markets are sending mixed signals, this morning —Treasury yields are spiking, small-cap stocks are finding new momentum, and big names like Nvidia are reaching new heights. On the corporate side, Robinhood is shaking things up with a new platform, and Uber has its eyes on a major acquisition.

Let’s break it down:

📈 Market Movers

① 🚀 Stocks to Watch

Elevance Health, Taiwan Semiconductor, and Lucid Group are the names to watch today. These stocks are making big premarket moves, and here’s why:

- Elevance Health is poised for action amid shifting healthcare policies and market demand.

- Taiwan Semiconductor is benefiting from the continued demand for chips, driven by AI and automotive industries.

- Lucid Group is facing pressure after announcing a public offering, which sent its stock tumbling.

Why It’s Happening:

Elevance Health is responding to the evolving healthcare landscape, while Taiwan Semiconductor is riding the global semiconductor demand wave. For Lucid Group, raising $1.67 billion is critical for expansion, but it spooked investors worried about share dilution.

Our Take:

Lucid’s offering might hurt in the short term, but the funds are essential for future growth. Taiwan Semiconductor remains a key player in AI and tech, making it a long-term stock to watch.

② Small-Cap Stocks on the Rise

Small-cap stocks have been quietly gaining traction, and analysts are starting to take notice. After a long period of underperformance, they’re starting to look like undervalued gems.

Why It’s Happening:

With the economy showing resilience, small-caps—which often lead during recoveries—are finally catching a break. Their potential for growth is high, especially if economic conditions continue to improve.

⚡ Energy in Flux

➤ Crude Oil Price Recovery

After a rough week, crude oil prices finally edged higher. West Texas Intermediate is trading at $70.40 per barrel, while Brent sits at $74.24. The easing of tensions in the Middle East has helped calm the markets.

Why It’s Happening:

With Israel holding off on any major strikes on Iran’s oil industry, fears of a supply disruption have cooled—for now.

Our Take:

Oil’s volatility isn’t going away anytime soon. While this price recovery is a relief, don’t expect calm seas—geopolitical risk still looms large.

💼 Corporate Move

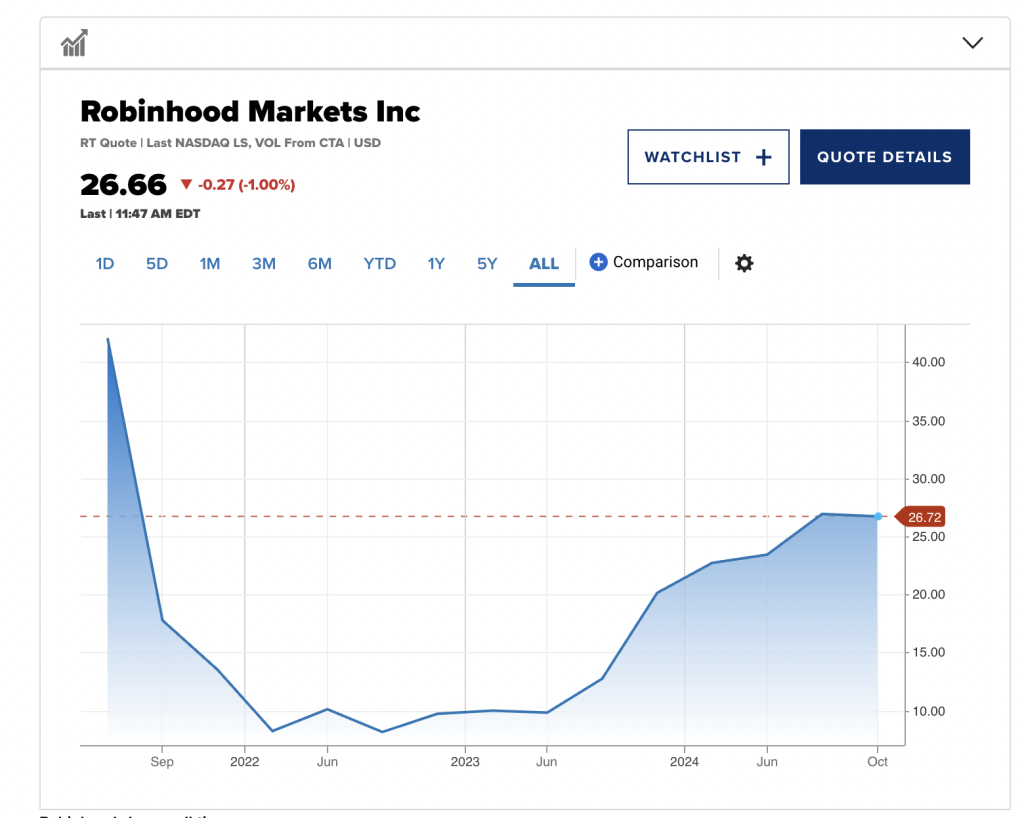

➤🏹 Robinhood Launches New Platform

Robinhood is stepping up its game with Robinhood Legend, a new desktop platform designed for more active traders. The platform offers advanced charting tools and futures trading options.

Why It’s Happening:

Robinhood is looking to expand its user base by catering to more sophisticated traders who need advanced tools to analyze stocks and make quicker decisions.

Our Take:

Robinhood is moving beyond its image as the platform for casual traders. If they can execute this well, they could grab a bigger slice of the market from more established players like E*TRADE and TD Ameritrade.

➤ 🚗 Uber’s Acquisition Talks

Uber is in talks to acquire Expedia, pushing the ride-hailing company into new markets beyond transportation and food delivery.

Why It’s Happening:

Uber CEO Dara Khosrowshahi, formerly CEO of Expedia, is looking to expand Uber’s footprint in the travel industry. This acquisition could diversify Uber’s services and provide new growth avenues.

Our Take:

This move could transform Uber into a travel powerhouse, offering everything from rides to bookings. If it happens, expect Uber to become an even bigger player in the global travel market.

➤ Blackstone’s Strong Quarter

Blackstone posted record assets under management of $1.1 trillion, boosted by $41 billion in Q3 inflows. The firm is seeing a revival in deal-making as the economic outlook brightens.

image source: cnbc.com

Why It’s Happening:

The Federal Reserve’s easing cycle has spurred more activity in the markets, and Blackstone is perfectly positioned to capitalize on this renewed deal-making environment.

Our Take:

Blackstone continues to lead the charge in alternative investments, and their strong performance shows they’re not slowing down anytime soon.

Indicators and Trends

➤ Treasury Yields Jump ⬆️

Treasury yields surged after stronger-than-expected retail sales data and a drop in jobless claims. The 10-year yield climbed to 4.093%, reflecting renewed confidence in the economy.

Why It’s Happening:

Retail sales jumped 0.4% in September, while jobless claims fell to 241,000. Together, these signals suggest the economy is more resilient than anticipated, leading to rising yields.

Our Take:

Higher yields can mean higher borrowing costs, but they also signal a strong economy. Keep an eye on how this impacts corporate debt and consumer loans in the coming months.

➤ Retail Sales Surge ⬆️

Retail sales rose by 0.4% in September, driven by strong discretionary spending as consumers felt the relief of lower gas prices. Restaurants, bars, and clothing stores saw significant gains.

Why It’s Happening:

Lower fuel costs gave consumers more spending power, and they took full advantage by splurging on goods and services. This spending is a positive sign for overall economic growth.

Our Take:

The holiday season is just around the corner, and if consumers keep spending like this, retail stocks could get a nice end-of-year boost.

➤ Jobless Claims Fall ⬇️

Jobless claims fell by 19,000 to 241,000, surprising economists who had expected an increase. Despite hurricanes and labor strikes, the labor market remains surprisingly strong.

Why It’s Happening:

The drop in claims shows that, even with external disruptions, the underlying economy remains resilient. Fewer layoffs indicate businesses are holding on to workers, possibly anticipating future demand.

Our Take:

A strong labor market keeps the economy humming. As long as jobless claims remain low, consumers will keep spending, which bodes well for economic growth in the short term.

➤ Yellen’s Tariff Concerns 😐

Treasury Secretary Janet Yellen expressed strong opposition to high tariffs, warning that they would raise prices for consumers and make U.S. companies less competitive globally.

Why It’s Happening:

Higher tariffs, particularly on Chinese imports, could disrupt supply chains and increase the cost of goods. Yellen’s warning is a reminder of the risks of protectionist policies.

Our Take:

Trade tensions and tariffs are always a wild card for investors. Keep a close eye on any developments—tariffs could reshape sectors like manufacturing, tech, and retail.

✂️ Quick Hits

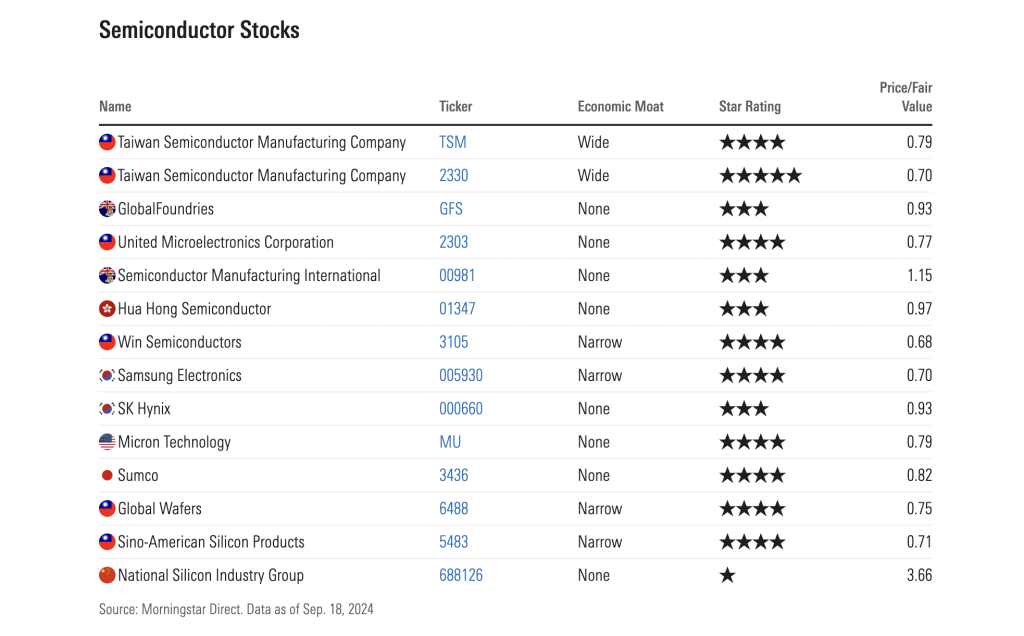

➤ Semiconductor Stocks Shine

The semiconductor sector is booming, thanks to AI and rising demand in the automotive industry. Companies like Taiwan Semiconductor and Nvidia are leading the way.

Why It’s Happening:

The global demand for semiconductors continues to outpace supply, pushing up prices and boosting the bottom lines of major chipmakers.

Our Take:

Valuations are high, so selective investing is key. Keep an eye on companies with strong fundamentals and innovative product lines.

➤ 🔍 Nvidia Hits Record High

Nvidia’s stock reached a new high of $140.89 as the AI trade reignites. Demand for GPUs from big names like Microsoft, Meta, and Amazon is driving this surge.

Why It’s Happening:

AI is the future, and Nvidia’s cutting-edge chips are powering the revolution. With new products like the Blackwell GPU on the horizon, Nvidia’s dominance isn’t slowing down.

➤ 💡 Meta Partners with Blumhouse

Meta is testing its AI video generation model, Movie Gen, in collaboration with Blumhouse Productions. The tool generates realistic video and audio clips based on user prompts, offering a glimpse into the future of AI-driven content

Why It’s Happening:

Meta is looking to integrate cutting-edge AI technology into the creative industries, giving filmmakers new tools to produce digital content.

Our Take:

This collaboration is a bold step in pushing AI into the entertainment world. If successful, it could revolutionize the way movies are made.

Quote of the day:

“Don’t watch the clock; do what it does. Keep going.” – Sam Levenson

The stinger

Disclaimer

This letter is not offering investment, trading, or investment advice nor is based on any individual portfolio or business operation. We are are not a registered investment, stock nor commodity advisor. One should consult with their own registered advisor to discuss investment strategies that are appropriate for their business or personal goals, risk tolerance and financial situation. Information in this report and on any website is derived from a variety of source believed to be reliable however no representation is made that the information is accurate, complete or correct. These lessons, newsletter and site content is not intended nor shall not constitute or be construed as an offer or recommendation to “buy”, “sell”, “trade” or invest in any securities, commodities, futures, options or other asset referred to in said lessons, reports or newsletters. Rather, this research is intended to identify situations and circumstances that those in the trading community should be aware of to better help assess and improve their own risk management skills.

* → Greedflation: presents an intriguing departure from conventional economic explanations of inflation.This concept suggests that profit-oriented businesses hold a substantial influence over the inflationary pressures experienced within economies. This novel perspective gains traction in the backdrop of current economic trends, particularly in regions like Europe and the United States.

However, the “greedflation” concept prompts us to question whether assigning inflation solely to corporate avarice paints an accurate picture or oversimplifies a complex economic reality.

TRENDING ORIGINALS

Never Miss What’s Happening In Business and Tech

Trusted By 450k+ Readers