Too hot.

In this buzz: Stocks, S&P 500, DJIA, Inflation, AMD launches AI chip and more…

The Buzz

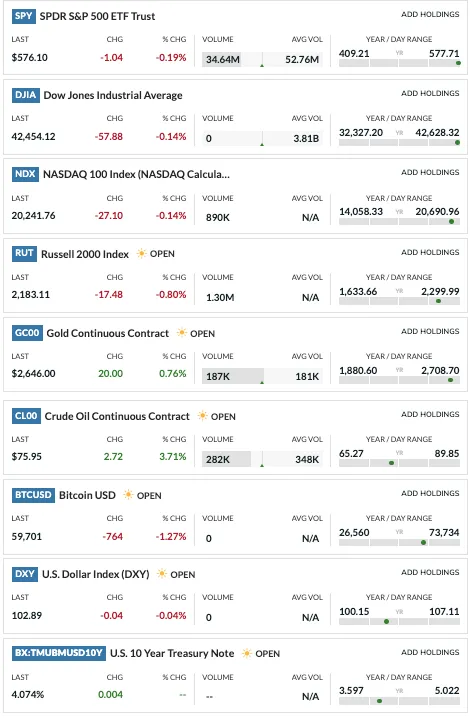

Stocks fell Thursday, with the S&P 500 and the DJIA falling from records, as economic data pointed to stubborn inflation and weakness in the labor market. The S&P 500 lost 0.4% on the day, while the DJIA fell 0.14% and the Nasdaq fell 0.3%. Most of the market’s focus was on the higher than expected inflation data in the form of September’s CPI report (discussed below).

DJIA

sources: Bloomberg, CNBC

Closing snapshot

sources: Marketwatch

“Attitude is a little thing that makes a big difference.” — Winston Churchill

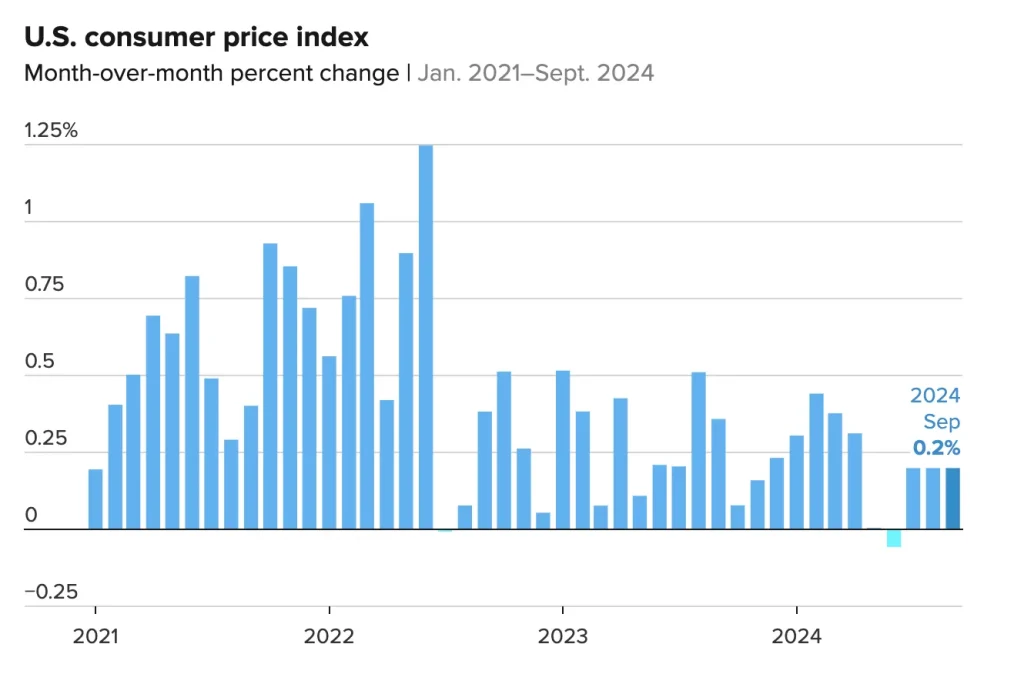

Inflation hotter than expected in September

While gains in the core consumer price index (CPI) remained steady in July and August, September saw an uptick in prices. On Thursday, the U.S. Bureau of Labor Statistics released the latest CPI data:

- Year-over-Year: 2.4% increase from a year ago versus expectations of 2.3%.

- Month-over-Month: 0.2% increase from August versus expectations of 0.1%.

- Core Year-over-Year: 3.3% increase from a year ago versus 3.2% expected.

- Core Month-over-Month: 0.3% increase from August versus 0.2% expected.

sources: CNBC, Bloomberg, WSJ, Barrons

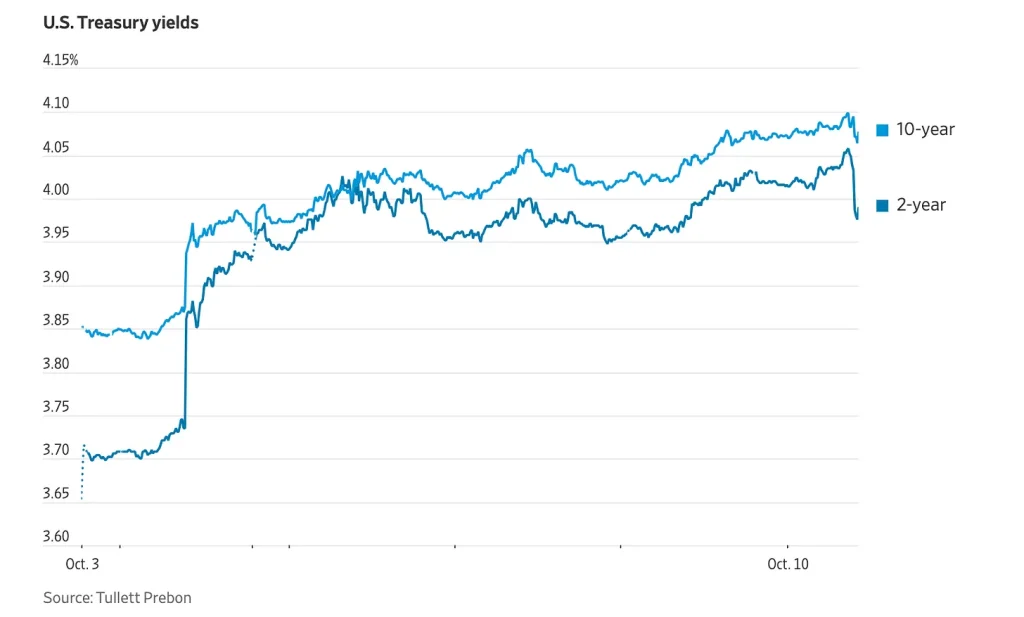

Short-term treasury yields fall

The higher than expected September CPI figures, combined with worse than expected labor data weighed on the short end of the U.S. Treasury yield curve on Thursday. The drop in short-term yields, which are more sensitive to the near-term outlook for interest rates set by the FOMC, suggests that traders were focusing on the higher than expected jobless claims data at least as much as on inflation. Despite a recent flurry of encouraging economic news, investors are sensitive to any signs of weakness in the labor market, which could push the Federal Reserve to cut rate more aggressively as it attempts to engineer a “soft landing” for the economy.

AMD launches AI chip to rival Blackwell

AMD launched a new AI chip Thursday that is a direct competitor to Nvidia’s data center graphics processors, or GPUs. AMD’s Instinct MI32X will go head to head with Nvidia’s upcoming Blackwell chips, which are due to ship in significant quantities in early 2025. Should AMD’s new chip be seen by developers and major cloud providers as a substitute for Nvidia’s product, it could put pricing pressure on Nvidia.

Advanced generative AI like OpenAI’s ChatGPT requires huge data centers full of GPUs in order to perform the required processing, which has created demand for more companies to manufacture AI chips. In the past few years, Nvidia has dominated the data center GPU market, with over 90% of the market share. AMD has historically been stuck in second place. Now AMD is gunning for Nvidia’s market share, which is estimated to reach $500 billion by 2028.

AMD has a great deal riding on these new chips. If successful, AMD could draw interest from investors looking for additional companies that will benefit from the AI boom. AMD shares are only up 20% so far in 2024, while Nvidia’s stock is up over 175%.

The biggest obstacle that AMD will face in grabbing market share from its rival is that Nvidia’s chips use their own programming language, CUDA, which has become standard among AI developers. That high switching costs, essentially locks developers into Nvidia’s ecosystem.

source: CNBC

Movers

- Toronto-Dominion Bank (TD) stock fell after the WSJ reported the Canadian bank could be fined $3 billion and face U.S. growth limits, as punishment for money-laundering lapses. TD’s U.S.-listed shares fell 4% following the news.

- American International Group (AIG) rose ~1% after being upgraded by JPMorgan, which said the finance and insurance company offers “outsized” earnings growth and capital flexibility.

- Shares of electric vehicle charging company EVgo rose early Thursday after UBS analyst William Grippin upgraded shares to buy from hold. Grippin’s price target increased by more than 100% to $8.50 from $4 a share.

- Shares of CVS Health Corp. (CVS) are moving above the 200-day Simple Moving Average (SMA) for the first time since April this morning after Barclays upgraded the healthcare conglomerate to “Overweight” from “Equal Weight” and increased their price target to $82.00 from $63.00.

- Delta Air Lines’ shares dropped after guidance for the current quarter pointed to a slower bounceback from challenges it faced earlier in the year. Delta announced Thursday that it expects Q4 earnings of $1.60 to $1.85 per share.

sources: IBD, WSJ, Barrons, Schwab, CNBC

Chart of the day

Domino’s Pizza (DPZ)

The the pizza-chain operator said U.S. orders continue to grow, it pared back guidance for store openings further, citing economic challenges. The company’s shares fell 3% on the announcement

Technically, the stock has been spending a lot of time consolidating in the 400 – 435 band. There’s support on the charts at 396.53, 360.95 and way below at 330.34. Resistance levels are 435.61, 450.22 and 460.83.

sources: ThinkOrSwim, WSJ

In other news:

- Initial filings for unemployment benefits came in higher than expected on Thursday. The seasonally adjusted figure of 258,000 for the week ended October 5 was the highest total since August 5, 2023.

- JPMorgan and Wells Fargo release Q3 earnings on Friday, kicking off bank earnings season. The third quarter was unusual, with volatile markets and the Federal Reserve’s first rate cut in years.

- The Social Security Administration (SSA) announced that more than 72.5 million beneficiaries will see a 2.5% increase to their Social Security and Supplemental Security Income benefits in 2025. This is the smallest increase since 2021 as the rate of inflation has subsided. Social Security retirement benefits will increase about $50 per month on average beginning in January.

sources: WSJ, CNBC, Bloomberg, Forbes, IBD, Reuters, Schwab Center for Financial Research

The stinger

Disclaimer

This letter is not offering investment, trading, or investment advice nor is based on any individual portfolio or business operation. We are are not a registered investment, stock nor commodity advisor. One should consult with their own registered advisor to discuss investment strategies that are appropriate for their business or personal goals, risk tolerance and financial situation. Information in this report and on any website is derived from a variety of source believed to be reliable however no representation is made that the information is accurate, complete or correct. These lessons, newsletter and site content is not intended nor shall not constitute or be construed as an offer or recommendation to “buy”, “sell”, “trade” or invest in any securities, commodities, futures, options or other asset referred to in said lessons, reports or newsletters. Rather, this research is intended to identify situations and circumstances that those in the trading community should be aware of to better help assess and improve their own risk management skills.

* → Greedflation: presents an intriguing departure from conventional economic explanations of inflation.This concept suggests that profit-oriented businesses hold a substantial influence over the inflationary pressures experienced within economies. This novel perspective gains traction in the backdrop of current economic trends, particularly in regions like Europe and the United States.

However, the “greedflation” concept prompts us to question whether assigning inflation solely to corporate avarice paints an accurate picture or oversimplifies a complex economic reality.

TRENDING ORIGINALS

Never Miss What’s Happening In Business and Tech

Trusted By 450k+ Readers