We’re waiting

In this buzz: “The scariest moment is always just before you start.”- Stephen King

“The scariest moment is always just before you start.”- Stephen King

The week ahead

After last week’s rollercoaster of a ride, the markets were generally quiet Monday as investors await some pretty important data points this week.

- Wednesday – The Labor Department releases July CPI data at 8:30am ET. We all remember what happened after the release of the June data, don’t we? Yikes!

- Thursday – Home Depot and Walmart report their second quarter earnings and we’ll get a look at July retail sales. Consumer behavior, always important as it drives 70% of the economy, is being closely watched this earnings season as there have been mixed signals of late in terms of slowing consumer behavior.

- Friday – The Commerce Department releases new residential construction data for July at 8:30 am ET.

Speaking of the CPI, option markets are pricing extra volatility around Wednesday’s release as well as Jay Powell’s Jackson Hole appearance later this month. Traders are expecting the S&P 500 to move 1.2% in either direction when the CPI data is released. Anyone willing to take the over?

In “no surprise news”, investors have been flocking to bonds as a hedge against risky assets and maybe trying to beat the rush if the Fed does embark on its widely anticipated rate-cut campaign next month.

source: Bloomberg, WSJ, CNBC

China

Investors pulled a record amount of investments from China last quarter amid continuing concerns about softening consumer demand, a slowing economy and increasing geopolitical tensions – Bloomberg

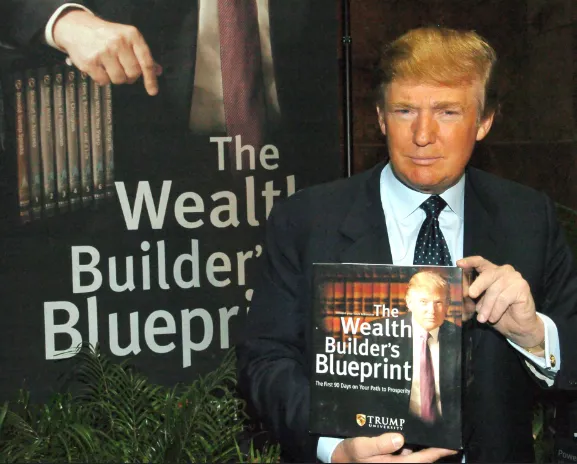

The Fed

Last week, Donald Trump said that he would like more control over the Federal Reserve, claiming he would have a “better instinct” then Fed officials in determining monetary policy than Fed officials and that he should at least be consulted about rate decisions. This statement alarmed investors and economists who believe that Fed independence is sacrosanct. Vice President Harris went on the record to say that she “couldn’t disagree more strongly” with Trump over this issue and vowed never to interfere with the Fed’s decision making. What could possibly go wrong?

source: Bloomberg, WSJ, CNBC

Real Estate

According to the Wall Street Journal, home affordability fell last fall to its lowest level since September 1985 and then fell back to that level in June. While many buyers then were priced out of the market, eventually home prices dropped in subsequent years. Today, first-time home buyers are faced with even tighter housing supply than was the late 80s.

source: Bloomberg, WSJ

Private Equity & Venture Capital

Vista Equity Partners, whose Cloud Software Group includes Citrix and Tibco, aims to raise ~ $5 billion to extend its investment in the parent company in what would be, if successful, one of the largest deals ever to cross the secondary market for private-equity stakes.

Vista, a technology-focused fund manager with assets of about $100 billion, is giving investors the option to cash out or remain invested by rolling their holdings into a new fund with a reset lifespan Vista pitched the opportunity as a way to “back a cash-rich company in a lower-risk information-technology segment with room to expand through acquisitions, said one potential investor who looked at the offering.”

In other news, P/E deal flow looks on track to outpace 2023 and evidence of fundraising constraints continue to ease as BridgeInvest, an asset manager focused on financing commercial real estate, wrapped up its fourth private credit fund after collecting more than $670 million for the pool and parallel vehicles according to the Wall Street Journal.

Crypto

- Bankrupt lending platform Celsius has filed a lawsuit against Tether seeking 39,542 BTC. According to the suit, the amount was collateral for a loan from the issuer of the Tether stablecoin. Tether requested additional collateral after the price of Bitcoin dropped in early 2022.

- After holding above the $60,000 level for four consecutive days, Bitcoin dipped to below $59,000. The cryptocurrency hit an intraday low of $58,269 after earlier reaching a high of $61,562.

- Bitcoin mining firm Marathon Digital Holdings is seeking to raise $250 million through a private offering of convertible senior notes as the crypto mining firm looks to double down on its Bitcoin holding strategy.

source: crypto.news

Nothing to see here…

* → Greedflation: presents an intriguing departure from conventional economic explanations of inflation.This concept suggests that profit-oriented businesses hold a substantial influence over the inflationary pressures experienced within economies. This novel perspective gains traction in the backdrop of current economic trends, particularly in regions like Europe and the United States.

However, the “greedflation” concept prompts us to question whether assigning inflation solely to corporate avarice paints an accurate picture or oversimplifies a complex economic reality.

TRENDING ORIGINALS

Never Miss What’s Happening In Business and Tech

Trusted By 450k+ Readers